Carriage Inwards in Income Statement

The most appropriate accounting treatment of carriage. They are preferably written off within the same year depending.

Carriage Inwards Freight Inwards Meaning Debit Or Credit

What is carriage outwards.

. By Net Loss transferred to Capital AC To marketingadvertisement. Contribution is the amount of earnings remaining after all direct costs have been subtracted from revenue. What is carriage inwards.

By income from other sources. Tally Erp9 Back up of data. The entries about the carriage inwards are posted in the trading account whereas the entries about the Freight outwards are posted in the income statement or profit and loss account Profit And Loss Account The Profit Loss account also known as the Income statement is a financial statement that summarizes an organizations revenue and.

Are repairs to office equipment and factory equipment period costs. To be classified as direct it must be possible to easily identify track or count the materials to a particular unit of production. Journalizes a reimbursement to the seller O C.

Shown on the debit side of an income statement. Inventory and Cost of Goods Sold. Go to Gateway of Tally Press F3.

Examples Direct labour wages cost of raw material power rent of factory etc. Tutorial financial statement with adjustments question the following trial balance was extracted from the books of mega enterprise as at 31 december 2017. The concept of TDS was introduced in the Income Tax Act 1961 with the objective.

Every company prepares a Profit and Loss Accountstatement at the end of the year generally to get the visibility of the income earning expenses and loss incurred in a specific range of period. Dismiss Try Ask an Expert. Introducing Ask an Expert.

When goods are shipped FOB destination and the seller pays the freight charges the buyer A. What are inventoriable costs. Carriage inwards is the shipping and handling costs incurred by a company that is receiving goods from suppliers.

Carriage inwards Direct expenses. Reflection in a Statement. Is rent expense a period cost or a product cost.

It is important to prepare Profit and Loss statement because this information helps an organisation to take the right business decision like where should we do the cost-cutting from where can a. In the formula raw material purchases is equal to the gross raw material purchases of the business including carriage inwards less any purchase returns allowances and discounts. Gross profit is equal to net sales minus cost of goods sold.

To learn more see the Related Topics listed below. The portion which is written off from the gross profit in the current year is shown on the income statement and the remaining balance is placed in the balance sheet. The information about gross profit and net sales is normally available from income statement of the company.

The Auditor needs to set the following Tax Audit Rules and Payment Due dates for various clauses. To net profit transferred to Capital AC Balance Sheet. Net sales are equal to total gross sales less returns inwards and discount allowed.

Also known as pre-operative expenses preliminary expenses are shown on the asset side of a balance sheet. Company Info or Press AltF. Using the trial balance all the income and expenses related ledger accounts are compiled.

Does not take a discount. Compute the gross profit. We brought real Experts onto our platform to help you even better.

Trial balance is the steppingstone for preparing all the financial statements such as Trading and Profit loss account balance sheet etc. The following data relates to a small trading company. Journalizes a reduction for its accounts payable B.

Direct expenses can be allocated to a specific product department or segment. Enter the email address you signed up with and well email you a reset link. Should inventories be reported at their cost or at their selling prices.

To loss by firetheft. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. Trial balance is a bridge between accounting records and financial statements.

Carriage refers to the cost of transporting goods into a business from a supplier as well as the cost of transporting goods from a business to its customers. It is the amount available to pay for fixed costs. Back up of data can be carried out by executing the following steps.

Shown in Financial Statements. To carriage inwards. Ask study questions in English and get your answer as fast as 30min for free.

Helps to prepare financial statement. To any other expenses. Definition of Carriage Inwards.

Indirect expenses are usually shared among different products departments and segments.

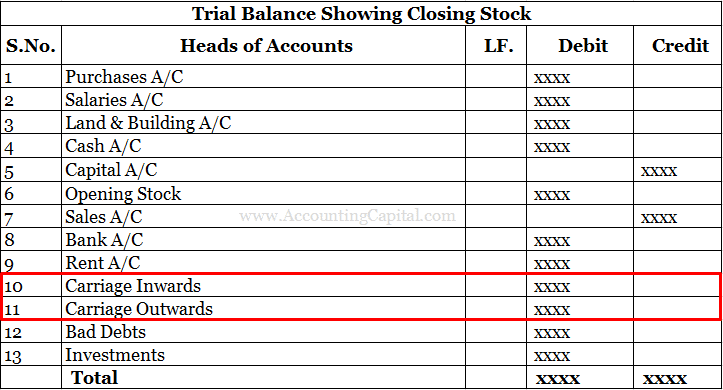

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

Components Of The Statement Of Profit Or Loss

Introduction To Financial Accounting Unit 6 1 Introduction To Financial Accounting Unit 6 Income Statement Structure Categories And Formats Ppt Download

No comments for "Carriage Inwards in Income Statement"

Post a Comment